- November 24, 2025

- Posted by: asfraresources

- Category: Uncategorized

Discover key edible oil market trends for 2026, including price forecasts, supply–demand shifts, and insights for importers & exporters of sunflower oil, palm olein, and soybean oil.

Introduction

The global edible oil market continues to evolve rapidly, shaped by climate conditions, supply chain disruptions, geopolitical factors, and changing consumer preferences. For importers, distributors, and manufacturers, staying ahead of the trends is crucial for optimizing cost, securing reliable supply, and maintaining competitive advantage.

At ASFARA RESOURCES, we support global buyers with export-ready refined sunflower oil, olive oil, and vegetable oils — ensuring consistency, reliability, and world-class production standards. Below are the key market trends expected to define 2026.

1. Crop Yields & Climate Impact Will Determine Global Price Movements

Weather patterns continue to influence seed production significantly. Droughts, floods, and temperature fluctuations have impacted sunflower seed and soybean availability across major producing regions such as Ukraine, Russia, Argentina, Malaysia, and the U.S.

What this means for buyers:

- Sudden price spikes may occur due to supply shortages.

- Forward contracts and pre-booking will become more important.

- Diversification of origin (Malaysia, Turkey, Eastern Europe) helps stabilize supply.

2. Rising Demand for High-Quality Refined Oils

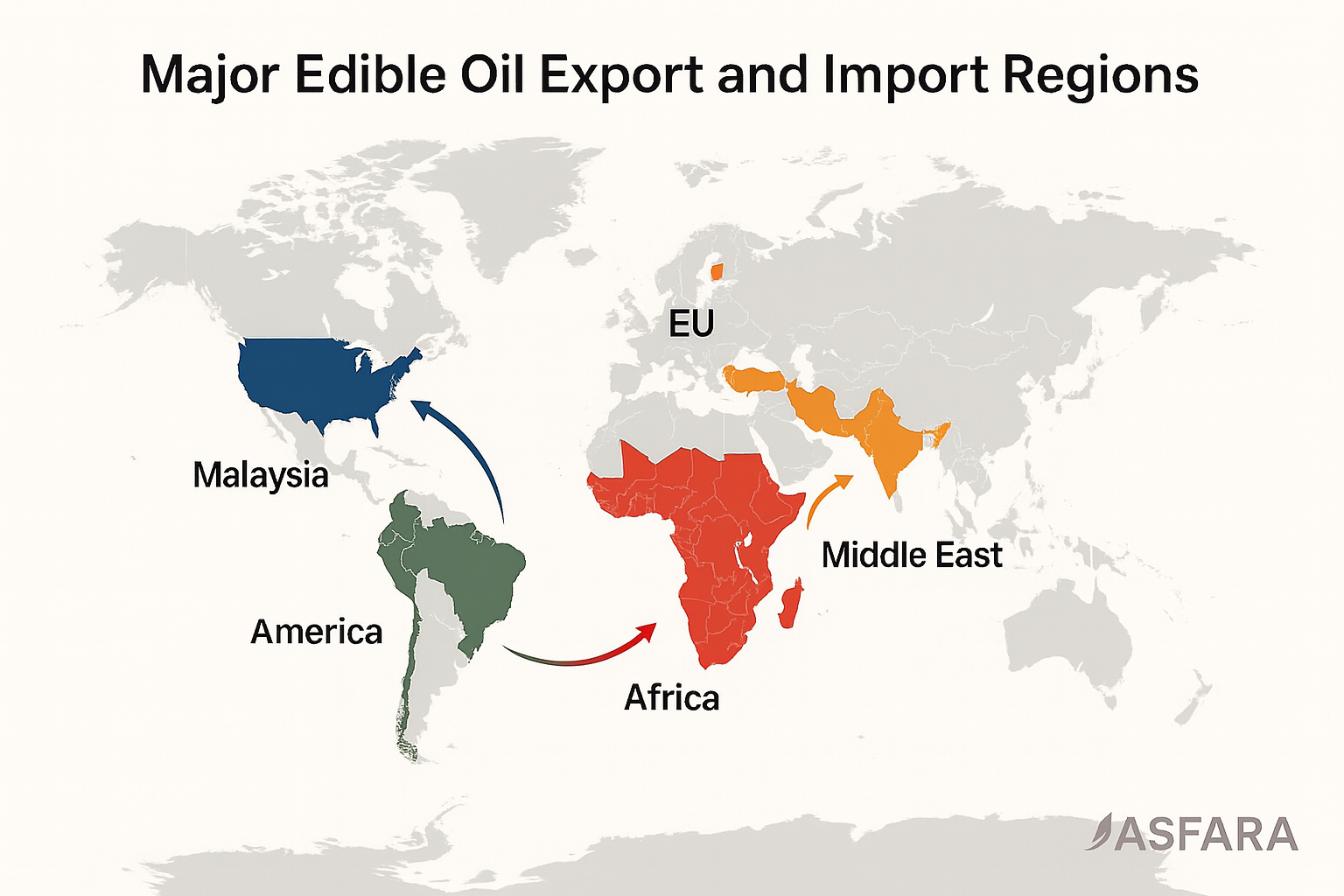

Markets like Africa, the Middle East, and North America are increasingly demanding:

- Refined Sunflower Oil (RBD)

- Palm Olein CP10/CP8

- Non-GMO vegetable oils

- Private-label retail packaging

This shift is driven by urbanization, higher incomes, and retail chains preferring consistent quality.

3. Logistics & Freight Volatility Are Becoming Normal

Container shortages, port delays, and higher freight costs have become standard over the past five years. This trend is expected to continue through 2026.

Impact:

- CFR/CIF quotations fluctuate frequently

- Shipping lines prefer long-term volume commitments

- Lead times vary from 18–35 days depending on port congestion

4. Growing Importance of Supplier Reliability

Quality consistency, documentation accuracy, and compliance (COA, MSDS, CO, Halal, ISO) are becoming decisive buying factors.

ASFARA RESOURCES continues to strengthen its production, bottling, and QC systems to meet global standards and ensure risk-free procurement for importers.

Conclusion

The edible oil market in 2026 will reward buyers who plan ahead, diversify suppliers, and partner with reliable production facilities. ASFARA RESOURCES remains committed to providing stable pricing, consistent quality, and dependable shipping from our modern production lines.

For inquiries, private-label projects, or long-term supply contracts, contact ASFARA RESOURCES today.